Millions of homeowners could see property taxes drop, if not disappear

Property taxes aren’t popular. Conservatives describe them as “renting your home from the government,” while progressives criticize them as one of America’s most regressive forms of taxation.

At least eight states will give lawmakers or voters the chance to greatly reduce their state’s property taxes, if not abolish them entirely, this year. It’s a populist sentiment, but some public officials worry about how their local governments will pay for essential services like police, fire and schools without that consistent stream of revenue.

Some states are looking to cut property taxes via legislation. Those bills hinge on the partisan sway of chambers and governors. Others are looking to bypass elected officials entirely, hoping ballot measures will catch the popularity of cutting a disliked tax that amounts to the lion’s share of a monthly mortgage payment in some states.

According to the Tax Foundation, every state has some sort of local property tax, and none have successfully abolished one. Several states have gotten rid of statewide property taxes, however.

How is property taxed?

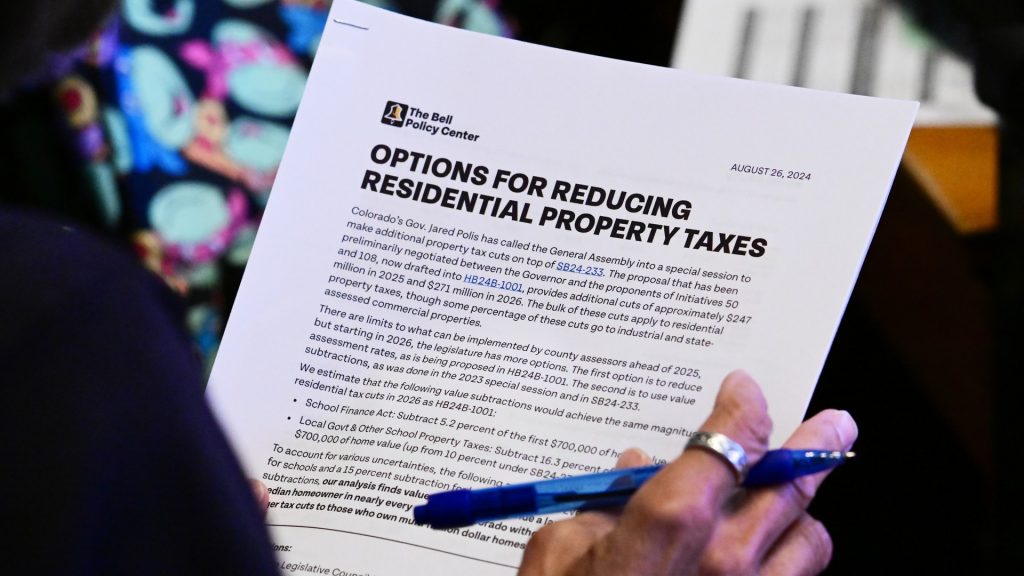

Unlike income taxes or sales taxes that depend on how much is made or sold, property taxes are measured largely by two factors: how much a property is worth — called an assessment — and how much the local taxing bodies want to tax it by.

Unbiased. Straight Facts.TM

Homeowners in Illinois paid an average of 1.96% of their home’s value to property taxes in 2024.

These factors are largely outside of a homeowner’s control, short of incurring the cost and inconvenience of moving. That’s the sting that millions of homeowners felt starting in 2023. COVID-19 pandemic-era interest rates were the primary driver of home prices increasing by nearly 40% between 2019 and 2022. Those higher prices led to marked assessment spikes in 2023 and the following years, sending property tax bills higher.

The eight states listed below have approximately 17.3 million homeowners, based on U.S. Census American Community Survey estimates and respective homeownership rates from 2023. Not all would be affected by the changes, but those states represent some of the highest-paying households in the nation.

Nebraska

Nebraska’s proposal isn’t new, but it’s likely the most expansive. Supporters of the EPIC Tax Option 2.0 are collecting signatures across the state. The ballot measure would eliminate property taxes, income taxes and inheritance taxes starting in 2028.

To offset the epic revenue loss, the proposal would impose a 7.5% consumption tax on nearly all new goods and services. A deep dive into the Tax Foundation’s proposition found that the rate would have to be more than 21%, something that would likely incentivize Nebraskans to cross state lines to do their shopping.

The organization behind the measure says lobbyists and special interest groups blocked property tax cuts in Omaha in recent years. Version 1.0 failed to get enough signatures to make the ballot last year.

Kansas

A proposal from Kansas state Rep. Blake Carpenter, R-Derby, gets its inspiration from Norway’s Sovereign Wealth Fund. House Concurrent Resolution 5014, if approved at the ballot box, would create the Freedom from Taxes Fund. Lawmakers would systematically eliminate sales tax exemptions and use that new revenue to fill the fund.

Over the years, Carpenter said the interest on that account would grow enough to offset property tax revenue that funds schools. He estimates that the state has around $9 billion in annual tax exemptions that would be considered.

If supporters can get enough signatures, the measure would appear on the November ballot.

South Dakota

A ballot measure in South Dakota would replace property taxes with a transactions tax.

An analysis by the Attorney General’s Office breaks it down. Instead of property taxes, the state would create an additional tax on retail purchases: a flat $1.50 fee on purchases of more than $15, and 10% of any purchases less than that. The new fee would be tacked on top of the state and city sales taxes.

Backed by a group called Abolish Property Taxes South Dakota, supporters have until May 5 to get more than 35,000 valid signatures.

North Dakota

Gov. Kelly Armstrong in 2025 took steps to not only lower property taxes but cap how much they can increase in a year. The moves are a part of his larger plan to completely eliminate property taxes in North Dakota in the coming years. The drop in revenue will be backfilled by the state’s Legacy Fund, an account worth billions of dollars from oil and gas revenue. As that fund increases, so will property tax refunds.

The legislation that tripled tax credits went into effect last August, meaning 2026 property taxes will reflect the change.

Ohio

The Ax Ohio Tax PAC is collecting signatures to get their ballot measure abolishing property taxes on the November ballot. It’s as straightforward as any: approval of the ballot proposition would abolish all property taxes in the state starting in 2027.

Unlike other Republican governors who have either supported or spearheaded property tax cuts, Gov. Mike DeWine is warning that a local sales tax of up to 20% would be necessary to fill the budget holes across the state.

“It would just be devastating to all kinds of local government, starting with schools, but also police and fire and children’s services,” DeWine told News 5 Cleveland on Feb. 5.

Pennsylvania

Legislation in the Pennsylvania House of Representatives, if enacted, would change the state constitution to forbid the taxation of all real property beginning in 2030. Sponsored by state Rep. Russ Diamond, R-Lebanon, the bill was filed early in the state’s 2025-2026 biennial session and has yet to be considered in committee.

Another lawmaker told Fox Business that the state could offset the revenue loss by taxing funds wired out of the country and university endowments.

Florida

Gov. Ron DeSantis has made abolishing property taxes a priority for his final term in office.

In his final State of the State address, DeSantis described residents being “locked into their homes” because of the tax levels for new residences. “Others have been priced out of the market entirely,” he added.

The governor called for a special session to address the issue.

Legislatively, House Joint Resolution 201 would get rid of all non-school property taxes for homeowners who take the homestead exemption. If successful in Tallahassee, the measure would get printed onto ballots in November. If voters like it, the broad tax reduction would take effect in 2027.

Illinois

Illinois consistently jockeys with New Jersey for the title of the state with the highest property taxes.

Efforts there to reduce property taxes have consistently stalled in the legislature, and citizen-based initiatives have a tougher hill to climb than other states to make it on the ballot.

The latest effort, Senate Bill 1862, would eliminate property taxes but only for residents who have lived in their home for 30 years. Filed in February 2025, the bill has yet to receive a committee hearing despite a host of bipartisan sponsors.

The post Millions of homeowners could see property taxes drop, if not disappear appeared first on Straight Arrow News.