Chicago move to end US Treasury bond buys met with mixed reactions

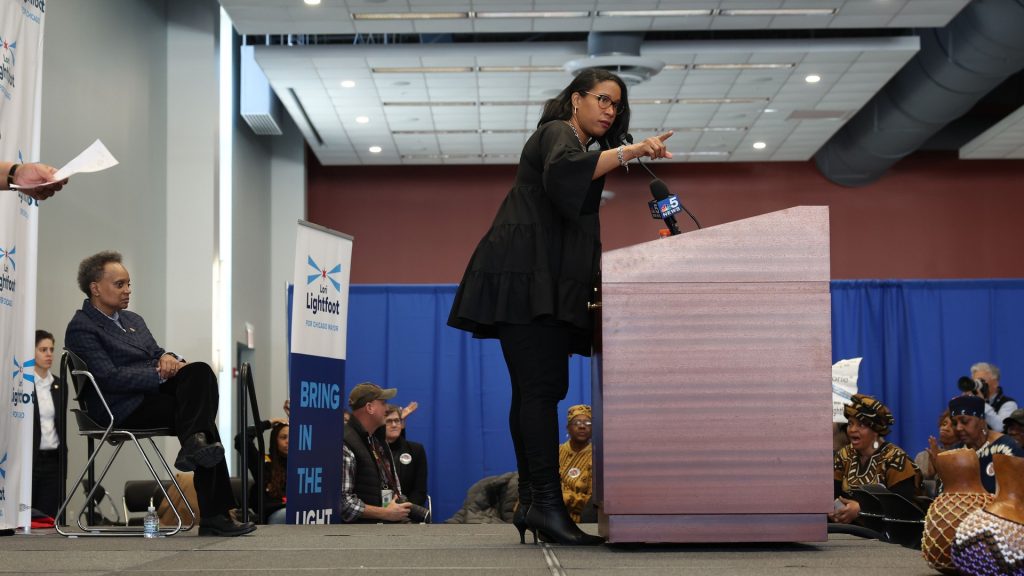

The treasurer of Chicago announced her city would no longer invest in U.S. Treasury securities. Melissa Conyears-Ervin said the move is to protest President Donald Trump’s administration.

While other U.S. cities have yet to do the same, some countries have pulled back from Treasury bonds in recent years.

Chicago pulls investment

Conyears-Ervin made the announcement during an annual budget hearing in front of the City Council’s Budget and Government Operations Committee.

“We will not bankroll Trump’s authoritarian regime,” Conyears-Ervin reportedly said in a Nov. 12 meeting, adding there are other ways for the city to invest.

She also said she hopes other cities will follow her lead and that Chicagoans will not feel any impact from this move.

“I have managed over $9 billion of taxpayers’ money for the past six years. We know what we’re doing. We can invest money in our sleep,” Conyears-Ervin said.

Last year, the city received $372.5 million in investment earnings, and Conyears-Ervin expects that figure to exceed $400 million this year.

Pushback

Democrats almost exclusively represent Chicago, and even some of the more progressive alders expressed concern over the move and what investments will replace the traditional investment.

“I think it was a political stunt,” Ald. Scott Waguespack, 32nd Ward, told ABC7 Chicago. “I think it was unfortunate and irresponsible for her to come and say that.”

Ald. Raymond Lopez, 15th Ward, called the announcement “reckless.”

Conyears-Ervin is currently running for a seat in the House to replace retiring Congressman Danny K. Davis and recently agreed to pay $30,000 to settle ethics violation claims.

The Chicago Tribune editorial board called it a reckless political stunt, while The Wall Street Journal’s editorial board took a more direct approach.

“Chicago politics these days is a contest between dumb and dumber, and the latter distinction this week goes to Chicago Treasurer Melissa Conyears-Ervin,” they wrote.

The Trump administration has not responded to her announcement.

US Treasury investment

The Chicago Treasurer’s Office manages the city’s $9.3 billion cash and investment portfolio. Conyears-Ervin said around $200 million of that was invested in U.S. Treasury bonds, or about 2%.

Treasury bonds, also known as T-bonds, are long-term, fixed-interest debt securities issued by the U.S. government that mature in 20-30 years.

They’re often considered risk-free because they’re backed by the government, which makes them an attractive investment for public figures. They cannot lose money when they mature.

It’s become even more attractive in the years following the COVID-19 pandemic. A report from Haver Analytics found state and local government holdings of treasury securities went from around $750 billion before the pandemic to $1.7 trillion last year.

The report listed three main reasons for that.

1) Federal government spending has gone up, particularly on infrastructure, which is often disbursed through state and local governments

2) Sustained economic growth under the Biden administration after the pandemic

3) Rising yields on short-duration treasuries allowed for solid income gains that compounded in state and local government accounts

State and local governments are now the second-largest holders of government treasuries behind the Federal Reserve.

Other countries like China have been pulling back their investments in U.S. Treasury holdings, especially amid trade tensions with the Trump administration.

The rapid expansion of U.S. debt, which is expected to continue to increase, has also led foreign countries to pull back their investments.

Despite that, total foreign holdings of U.S. Treasuries have continued to rise, reaching an all-time high in May 2025.

The post Chicago move to end US Treasury bond buys met with mixed reactions appeared first on Straight Arrow News.