A trader netted $400,000 by betting on Maduro’s capture. Was it insider trading?

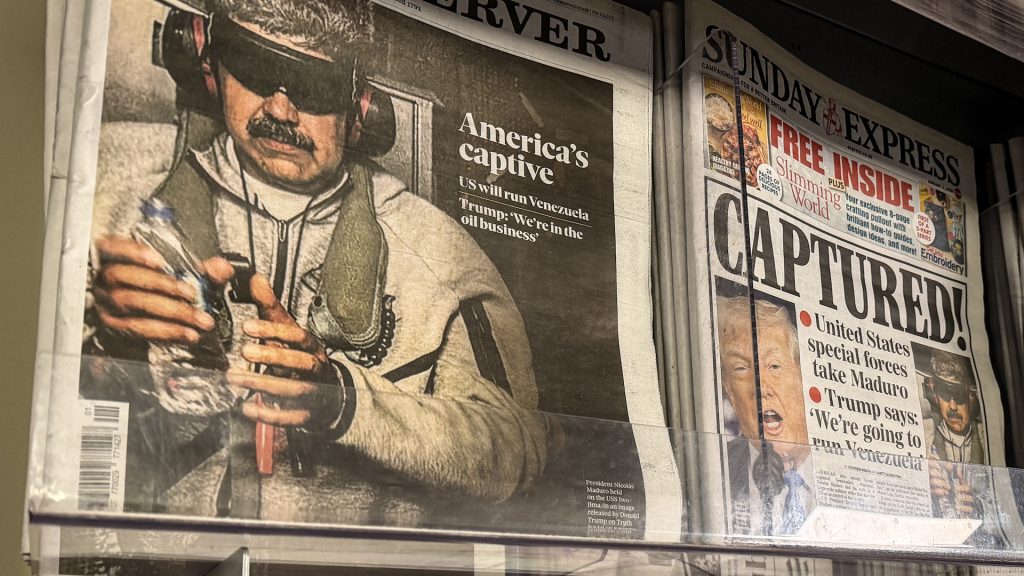

A multi-thousand-dollar bet on the fall of Venezuelan President Nicolás Maduro is fueling a new push to crack down on “insider trading” in the world of prediction markets.

Rep. Ritchie Torres, D-N.Y., plans to introduce the Public Integrity in Financial Prediction Markets Act of 2026, after a newly created Polymarket account turned roughly $30,000 in wagers on Maduro’s ouster into more than $400,000 in profit when U.S. forces took Maduro into custody.

Torres’ bill was first reported by Jake Sherman of Punchbowl News.

The Wall Street Journal reported that roughly $56.6 million had already been wagered on Maduro’s departure across at least six Polymarket contracts, including about $11 million tied to whether he would be out by Jan. 31.

Why a Venezuela bet is triggering a crackdown push

The proposed legislation aims to apply insider-trading rules to a fast-growing corner of finance where political and policy outcomes are turned into tradable contracts. Prediction markets generated more than $44 billion in combined trading volume in 2025, The Block reported.

Prediction markets already draw scrutiny over whether well-connected traders can use advanced knowledge of government decisions to profit, a concern Axios said the Maduro bets are likely to revive.

The bill would extend principles from the STOCK Act, which seeks to block insider trading by members of Congress, to prediction markets by targeting trading based on “material nonpublic information.” That debate now intersects with U.S. foreign policy.

What Torres’s bill would do — and how platforms respond

The proposed law effectively extends insider trading rules to these platforms. It would strictly prohibit federal lawmakers, appointees and executive staff from wagering on political events if their official positions give them access to sensitive, nonpublic data.

A spokesperson for Torres told The Block the bill had been “in the works for a bit,” but that news of the Venezuela bet stressed the urgency of “introducing the bill as soon as possible.”

The bill does not yet have any co-sponsors, the spokesperson said, but Torres hopes to build a broader coalition in the coming weeks. In response to the emerging legislation, the press relations account for prediction market Kalshi noted on X that trading on material nonpublic information by “insiders or decision-makers” is already prohibited under that platform’s rulebook.

The Block also noted that Donald Trump Jr. holds advisory roles at both major prediction market platforms. He has served as a strategic adviser to Kalshi since January 2025 and joined Polymarket’s advisory board in August, following an eight-figure investment by his venture capital firm.

Maduro markets show how fast big bets can move

The timing and scale of the Maduro trades have fueled questions about who knew what, and when. The Journal reported that odds on Polymarket that Maduro would be out of power by Jan. 31 hovered around 5% to 6% for most of a week before climbing shortly before 10 p.m. Eastern time Friday, hours before the U.S. assault on Venezuelan targets began.

The market remained volatile overnight, hitting even odds at 1:45 a.m. and briefly swinging back to favor Maduro remaining in power. However, minutes later, the sentiment reversed entirely, with the probability of his exit skyrocketing to over 95%.

Axios reports that a newly created Polymarket account invested about $30,000 on Maduro’s exit on Friday and later showed a profit of $436,759.61 after Maduro’s capture was confirmed Saturday morning.

The post A trader netted $400,000 by betting on Maduro’s capture. Was it insider trading? appeared first on Straight Arrow News.