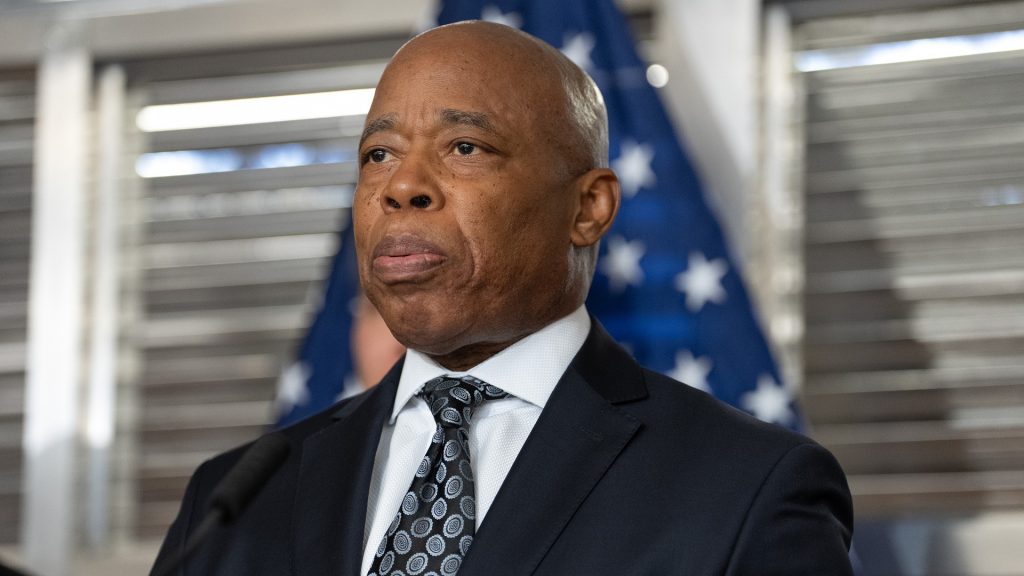

Former NYC mayor Eric Adams accused of crypto scam shortly after leaving office

Former mayor of New York City Eric Adams is being accused of a crypto scam just a few weeks after leaving office. Adams allegedly made several million dollars using a common method of deceit called a rug pull.

NYC Token

Earlier this week, Adams held a press conference in Times Square to push his new meme coin, the “NYC Token.” To attract investors in the new coin, Adams said it would be used to fight antisemitism, anti-Americanism and more.

Adams’ announcement of the new coin did not offer many other details, including who else was backing the coin. But with Adams as the face of the new venture, people bought in, and the coin’s price rose to a $580 million market capitalization.

During his time in office, Adams had been a big backer of cryptocurrency, even attempting to take mayoral paychecks in Bitcoin.

“He’s all about using crypto to close the digital divide and for financial inclusion, and also, in this particular case, he was promoting this NYC coin as something that would support a foundation,” Bill Maurer, professor of anthropology and law at the University of California, Irvine, told Straight Arrow News.

That’s part of what brought in some of those investors, according to Maurer.

“The reason why people buy into these sorts of things, really is just the classic fear of missing out, or what people call FOMO, right?” he said. “There’s so much hype in the crypto space. People really have the belief that some of these cryptocurrencies are an opportunity to make a quick killing.”

Rug pull allegations

Once that coin’s price skyrocketed, blockchain data revealed a wallet linked to the deployment of the token removed $2.5 million in liquidity, essentially pulling most of the value from the token.

Roughly $1.5 million was later added back in after the value had dropped. Some $900,000 was never added back in.

“It’s a specific form of scheme where the insiders get people to invest and then they sell into that,” John Griffin, professor of finance at the University of Texas, Austin, told SAN.

Rug pulls have become more common in recent years, including another famous example with viral internet personality Hailey Welch.

“They’re like, here’s our new coin, and we’re putting in $3 million,” Maurer said. “It’s the best thing since sliced bread. Go for it. And then, they attract a bunch of investors who buy this coin. But then after it reaches a certain value, they pull out their initial investment, plus, right? So, it’s like pulling the rug out from under the investors.”

Pulling out that money leaves the token with little or no value.

“These types of speculative ventures on the blockchain are around all the time, and they’re just costing people,” Griffin said. “They’re costing a lot of people their savings, and generally, they’re kind of a leech on society.”

Adams has not publicly commented on the allegations.

What comes next?

Are rug pulls illegal?

“It’s really murky, and it is especially murky now,” Maurer said.

Griffin echoed similar sentiments.

“Pump and dumps are illegal,” Griffin said. “Particularly in the crypto space, there’s less of an appetite to prosecute them.”

Last year, President Donald Trump signed the GENIUS Act, which aimed to regulate crypto coins with safer liquid assets like dollars or Treasury bills.

“Before the GENIUS Act, and before the current administration in Washington, very likely there would immediately have been an investigation by the Securities Exchange Commission, because that was the entity that was tasked with regulating crypto, looking into things like this,” Maurer said.

However, Trump moved oversight away from the Securities and Exchange Commission.

“As soon as Trump came into office, his team switched regulatory oversight of crypto from primarily from the SEC to the CFTC, the Commodity Futures Trading Commission, treating crypto more like an asset, more like a commodity, and less like a security, and so different regulations apply,” Maurer said.

Investors may still have a legal claim, but Griffin believes that’s likely an uphill battle.

“Usually for lawyers to take on a case like this, they need a lot more losses, but yeah, some smaller lawyer might take it on,” he said.

Protecting your investments

So, how can people who want to invest in crypto coins protect themselves?

“Most investors are not sophisticated enough to check the mechanisms and even so, the mechanisms that might protect investors can often be circumvented,” Griffin said.

Maurer agreed that people need to do their research before any kind of investment.

“The first thing to do is, any issuance of a new cryptocurrency, any new crypto venture, should somewhere have posted online a white paper explaining what they’re doing,” he said. “You should look at it.”

While making sure you get a look at what they’re doing, Maurer said making sure it’s legitimate is another crucial step. And artificial intelligence may be able to help you do just that.

“Often what folks will do is just cut and paste from another white paper, right?” Maurer said. “If they’re doing something illegitimate, if what they’re launching really is kind of a scam, they’re just putting garbage out there. And you can probably ask a [large language model] of your choice, has this white paper budget just been plagiarized?”

Rug pull scams are becoming more constant, costing investors hundreds of millions of dollars.

“In general, individuals would be good not to put money on any of these speculative investments,” Griffin said. “But sometimes people have to learn the hard way.”

The post Former NYC mayor Eric Adams accused of crypto scam shortly after leaving office appeared first on Straight Arrow News.